The size of the global e-commerce automotive aftermarket is expected to reach US$143.9 billion by 2028 — a growth rate of 14.6% over forecasts, according to a recent report.

But it’s established online retailers that appear poised to see the biggest benefits as shopping habits that changed during the pandemic are expected to stick around.

With more and more automotive replacement parts becoming available on online platforms, customers are getting more access to parts and affordable options to buy, said Grand View Research.

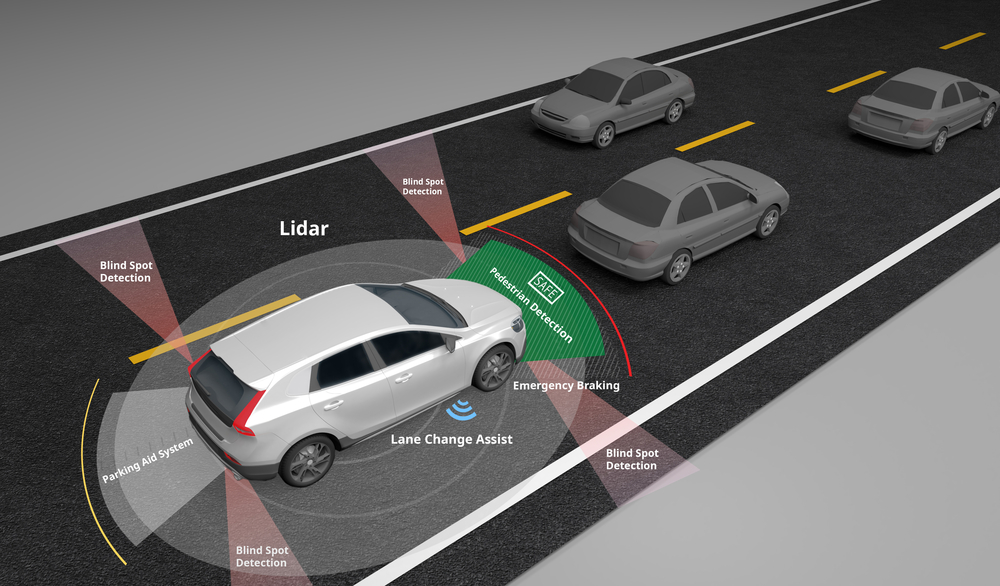

“Improved supply chain activity with technology deployments such as the Internet of Things (IoT) and automation has boosted the growth of e-commerce platforms in the automotive sector,” the company said in an announcement. “Further, rising awareness of automotive OEMs to establish an omnichannel presence promotes them to deploy e-commerce practices, thereby offering growth opportunities for the e-commerce aftermarket parts.”

Karolina Grabowska/PexelsThe fastest-growing segment is expected to be lighting. “The growth can be attributed to the ongoing trend of automobile owners to customize and install new and personalized lighting equipment for interiors and exterior uses,” Grand View Research observed.

The North American market “dominated” sales in 2020, the report said, with a revenue share of 30.5%. “The high revenue share can be attributed to the penetration of a highly organized e-commerce ecosystem that facilitates automotive equipment manufacturers to engage in e-commerce specific aftermarket sales.”

As the economy continues to rebound, further market growth is expected, it added.

Companies benefiting the most from e-commerce sales are those that are making the most investments in the space.

“E-tailers are continuously challenging traditional retailers by penetrating the market more effectively,” Grand View Research said. “This has led to the emergence of companies such as RockAuto and Tire Rack and also promoted companies such as Alibaba and Amazon to increase investments in the automotive aftermarket sales segment. This has led to an increase in automotive equipment sales via e-commerce channels, and the trend is expected to continue over the forecast period.”

The global COVID-19 pandemic moved much of the world to stay home and shop more online. Reduced trips to physical stores is expected to continue, “which will help the e-commerce automotive equipment shopping trend stay buoyant,” the company said.

Leave a Reply