The do-it-for-me (DIFM) auto repair market is on the verge of significant transformation, with Gen Z poised to play a larger role beginning in 2026.

According to a new report by Lang Marketing, this shift will reshape buying habits in the auto repair industry, where 90 per cent of the current market is dominated by Baby Boomers, Gen Xers and Millennials (or Gen Y).

The report, Evolving Generations Change DIFM Buying Habits, looked at how the DIFM market shares of these generations have evolved over the past decade. In 2013, Baby Boomers accounted for approximately 33 per cent of the DIFM volume, but by 2023, their share had declined to 23 per cent. Gen Xers, on the other hand, increased their market share, climbing from 32 per cent in 2013 to 35 per cent in 2023.

Millennials saw the most substantial growth, expanding their share from 28 per cent in 2013 to 33 per cent in 2023. Consumers born before 1946, as well as Gen Z, made up less than 10 per cent combined of the DIFM volume in 2023.

Expected changes by 2030

Looking ahead to 2030, Lang Marketing projects notable shifts in the generational composition of the DIFM market. By that time, Baby Boomers’ DIFM share is expected to drop to below 12 per cent, while Gen Xers’ share will sit and stay at around 36 per cent.

Millennials are predicted to generate the largest portion of DIFM volume by 2030. Gen Z is expected to account for nearly 14 per cent of the market, a significant rise from their current impact.

Generational differences

Previously, Lang Marketing looked at how ‘digital natives’ are set to transform the auto care sector as that generation grew up with digital technologies, as opposed to ‘digital immigrants’ who adopted them.

In this report, the group also highlighted striking generational differences in how consumers engage with auto repair services. These differences span preferences for online purchasing, calling repair outlets and visiting repair shops in person.

Online outlet selection

Across all three generations currently dominant in the DIFM market, about one-third of consumers prefer buying auto repair services online. However, Millennials stand out, with nearly half opting for online purchases over calling or visiting repair outlets.

Gen Xers are less inclined, with just under one-third favoring this approach, while only one-fifth of Baby Boomers prefer to purchase auto repair online. These differences underscore the varied contributions of each generation to online-to-offline (O2O) growth in the DIFM sector.

Calling repair outlets

Calling repair outlets to arrange auto repairs remains a popular choice for more than 30 per cent of consumers, but there are generational distinctions.

More than 35 per cent of Gen Xers prefer this method, making it their top choice. It is the second most popular option for Baby Boomers (just under one-third), but only about one-quarter of Millennials opt for calling as their primary method.

Visiting repair outlets

Visiting repair outlets in person to make auto repair arrangements is most preferred by Baby Boomers, with nearly half choosing this method. This option is much less popular with Gen Xers (around 30 per cent) and even less so with Millennials, only about one-fifth of whom prefer to visit repair shops.

Baby Boomers are more than twice as likely as Millennials to favor in-person visits, while Millennials are more than twice as likely to choose online purchasing.

Shifting Market Landscape

The findings of the Lang Marketing report illustrate how evolving generational preferences are reshaping the DIFM market.

“Within each of the three major generations, there are significant differences in auto repair purchasing based on gender, vehicle nameplate (domestic versus foreign) and vehicle age, among other factors,” Lang observed.

As Gen Z enters the scene and Millennials become the dominant force, the industry is likely to see a continued rise in online purchasing and a decline in traditional, in-person repair shop visits. Understanding these generational preferences will be key for auto repair businesses looking to adapt to the future of DIFM and attract the next wave of consumers.

“By the end of the decade, there will be significant changes in the do-it-for-me share held by each of the three consumer generations,” Lang said.

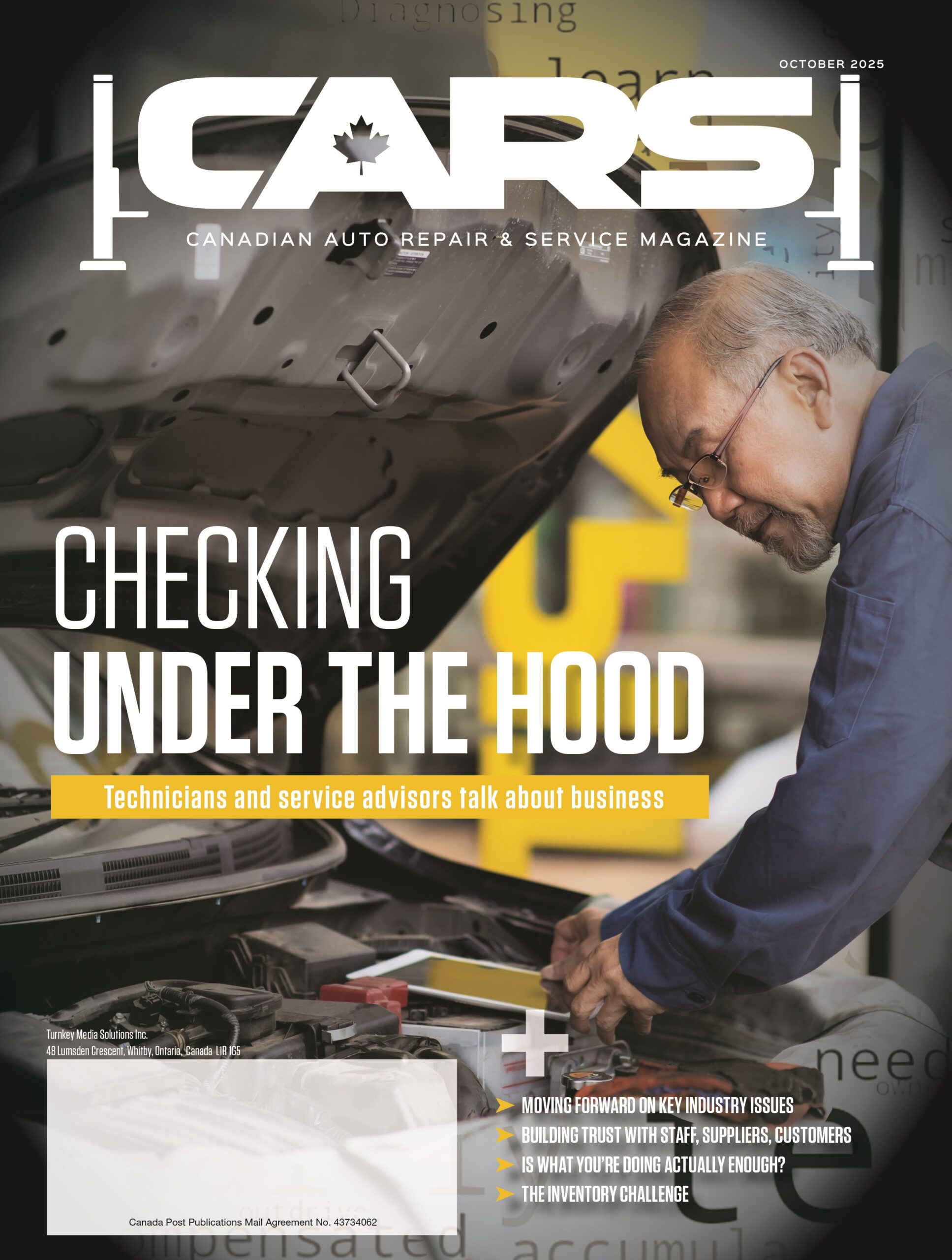

Image credit: Depositphotos.com

Leave a Reply