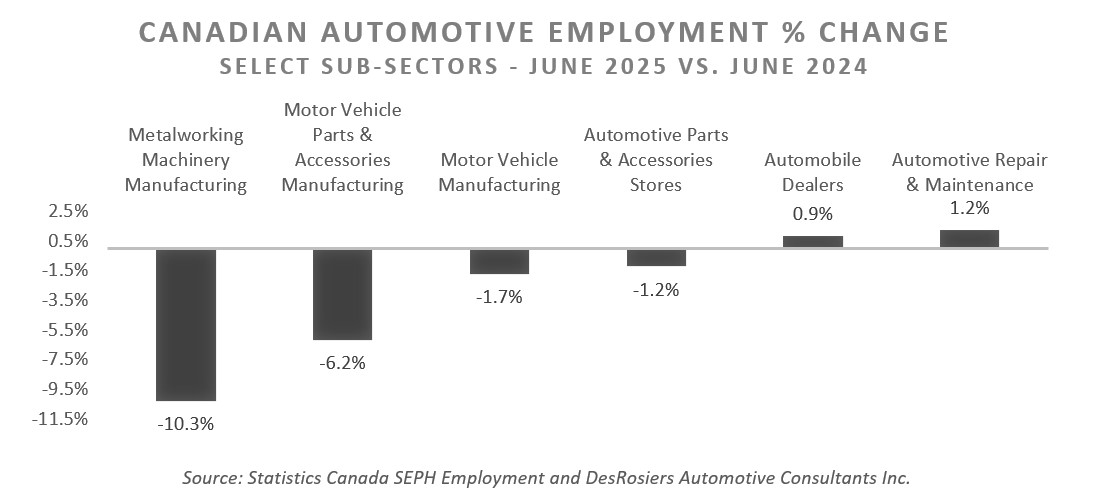

With new vehicle sales under pressure from tariffs and economic uncertainty, car dealers are doubling down on internal combustion engine repair as new vehicle sales are expected to stall.

With challenges out of the way and consumer demand building, new vehicle sales were expected to be robust in 2025. But that hasn’t quite been the case. After early momentum, the pace has slowed as the year has continued on. For example, DesRosiers Automotive Consultants reported that typically robust May sales — which topped 200,000 units in May from 2017-2019 — reached 187,000 this year. While up from 2024, numbers are still recovering.

But that slowing momentum continued into June with 178,000 units sold, according to DesRosiers. That brought the seasonally adjusted annual rate (SAAR) falling to 1.81 million — the lowest level so far in 2025.

And as tariff uncertainty hits, consumers are concerned about making the investment. In response, dealers are leaning harder into a more reliable profit centre: Their service bays and used vehicle operations, particularly catered to ICE vehicles, to make up for lost ground.

According to Lang Marketing, this pivot is more than a short-term fix — it’s a strategic shift. Even if new vehicle sales recover, dealers are expected to maintain their focus on ICE vehicle repair, especially as electric vehicle (EV) adoption grows and threatens to erode service bay revenue.

The trend isn’t new. After the 2008 recession and the COVID-19 pandemic, dealers began expanding their service offerings to stay afloat. Many started marketing to a broader range of vehicle ages and brands, adding quick lube lanes, extending service hours and offering rapid repair options.

Used vehicle sales have also become a key part of the strategy. Not only do they offer higher margins than new cars, but they also generate ongoing service opportunities. Dealers are incentivizing used car buyers to return for maintenance and repairs, often through service contracts and promotions.

Between 2015 and 2019, dealers increased their share of the car and light truck repair market, reversing a seven-year decline. That momentum continued through the pandemic, with service bay business growing from 2020 to 2023. While 2024 data is still pending, Lang Marketing expects the upward trend to continue.

Now, with tariffs threatening to delay a full recovery in new vehicle sales, dealers are doubling down on ICE repair. Their goal is to attract a wider range of vehicles — both in age and brand — to their service bays, Lang reported.

This shift is expected to intensify competition in the aftermarket. Independent repair shops, which have long dominated the do-it-for-me segment, will face increasing pressure as dealers expand their reach and invest in capturing more ICE repair business.

Lang Marketing predicted that dealers will continue to grow their share of the DIFM market in the coming years, using ICE repair as a hedge against the uncertain pace of EV adoption and the volatility of new vehicle sales.

“The independent (non-dealer) repair outlets must adapt to changes that dealers are bringing to the ICE vehicle repair market and the strong likelihood that dealers will continue to expand their share of the increasingly competitive do-it-for-me market in the coming years as they focus on ICE vehicle repair as a key to their viability,” the report said.

Image credit: Depositphotos.com

Leave a Reply