Show Report: Aftermarket Parts Rule in Vegas

Share

Share

Aftermarket enhancements are king in Las Vegas 365 days a year, but for one week in November the automotive business comes to town.

In the city whose motto should be, “Why settle for what God gave you?” it’s no wonder that the arrival of project vehicles and concept cars is greeted with such enthusiasm. It should be noted that the tens of thousands of aftermarket professionals who flock to the city for Automotive Aftermarket Industry Week are equally welcome in the casinos and attractions that abound in the oasis of adult pleasures that is Las Vegas.

What’s not to be lost is, however, the fact that North America’s largest show of aftermarket products–actually three shows in two venues–is the real draw. As the biggest event of its kind on the continent, it is the best launching ground for new products and new forays into the aftermarket. While most of the flashy cars were at the Specialty Equipment Market Association Show and the International Tire Exposition, the real meat and potatoes announcements took place at the Automotive Aftermarket Products Exposition (AAPEX).

Perhaps the largest launch was that of TRW’s return to the undercar aftermarket, via its Autospecialty brand (see Over the Counter). The announcement certainly had the show floor buzzing.

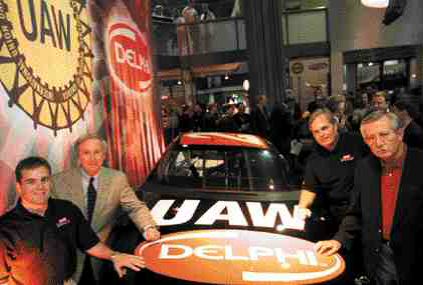

In addition, there was Delphi’s official launch into the U.S. aftermarket. While we in Canada have had a heads up for the past eight months, our counterparts to the south have been prevented from seeing what Delphi will bring to the market until now. With an actual launch date of January 1, 2001, Delphi took the opportunity to show its greater capabilities, including a Garage of Tomorrow, which is actually the potential garage of today since all of the diagnostic and recording tools there are virtually ready for the market. Its Driver’s Seat Diagnostics tool offers wireless communications and integrated diagnostics, online training and transaction processing. The system promises to be at least the framework for a new approach to dealing with the automotive repair customer. Oh, Delphi also took the opportunity to launch its NASCAR Winston Cup effort with co-sponsor the United Auto Workers.

OE supplier-turned-aftermarket player Visteon was also conspicuous by its attendance. As last year, it had a number of multimedia products on display as well as two notable traditional aftermarket announcements. On the product side, it announced that it would be building replacement a/c compressors for the GM HT type unit. This is notable because the compressor Visteon is building is actually based on the Ford FS10 unit, which it already builds, but packaged to fit GM HT applications. The compressor uses the 10-cylinder design of the FS10 and has a 170-cc pump, versus the 140-cc capacity of the OE unit.

In addition, Visteon has teamed up with Snap-On Inc. Training Solutions to provide climate control systems training throughout North America. With classes slated to start in March, Visteon will develop the courses and it was confirmed that training materials would be tailored for the Canadian market’s regulations and procedures. Initially, three classes will be offered: Air conditioning systems and operations; a/c retrofitting; and a/c refrigerant handling certification.

As last year, electronic commerce was a big part of the discussions. Unlike last year, however, there were actually some products being shown that were available for purchase. While we’ll cover more of this off in the January issue of Jobber News Magazine, it’s worth noting that at least the first hurdle has been conquered: getting products to market.

One of the highest profile announcements was Autovia’s new distributor model. The company had come under fire from distributors for its initial shop-centered model, which distributors and jobbers found hard to buy into due to its emphasis on side-by-side price comparisons. The new model has a tiered approach to suppliers–first call, second call and so forth–and more options that cater to the needs and wishes of the wholesaler. The company has also been busy signing deals to expand its connectivity with various computer systems out there.

In addition, CCI/Triad was busily touting not just its new inventory management products, but also its Aftermarket ConneX (AConneX) Internet connectivity suite. AConneX allows for Internet ordering and fulfillment, and connects any CCI/Triad supplier system.

In addition to the dot-coms in attendance, many of the traditional players were also touting their entry into e-commerce. One of the notable entries is that of Federal-Mogul. The fmconnect network includes a variety of web-based services ranging from electronic catalogs and tech bulletins to on-line marketing programs and training registration.

Johnson Controls was actively talking up its new autobatteries.com site, which provides consumers with useful battery information.

Another Internet foray was being touted by ArvinMeritor, which didn’t let the fact that it wasn’t exhibiting stop it from working the press effectively. The company joined head-to-head competitor Tenneco Auto-motive as the two players most conspicuous by their absence from the show floor.

Both companies currently have a lot of business issues to tackle, but ArvinMeritor president Dan Daniels said that the fact that both were absent from the show was just coincidental. He says that the multi-billion dollar merger of Arvin and Meritor was a tremendous undertaking and was demanding so much of the company’s efforts that it opted to sit out for a year. He says that he only heard of Tenneco’s plans not to exhibit after the decision was made by ArvinMeritor to do the same. In any case, their mutual absence probably made it easier for these competitors to stick with their decision.

And if there were any doubts about the international nature of the show, they should be put to rest after The Automotive Aftermar-ket Alliance (Auto Value/Bumper to Bumper) and Temot International, a European program distribution group, struck a strategic alliance. Both organizations touted the common supplier base and their respective international networks in the deal. “For many products we share the same suppliers,” says Frans van Heck, president of Temot International, “and we both see many possibilities to improve the efficiency of the supply chain.”

Leave a Reply