How EV batteries can find a second life

Share

Share

Second-life battery storage technologies are struggling to compete with first-life Li-ion battery energy storage systems (BESS), but new revenue opportunities could change the landscape, according to a recent analysis.

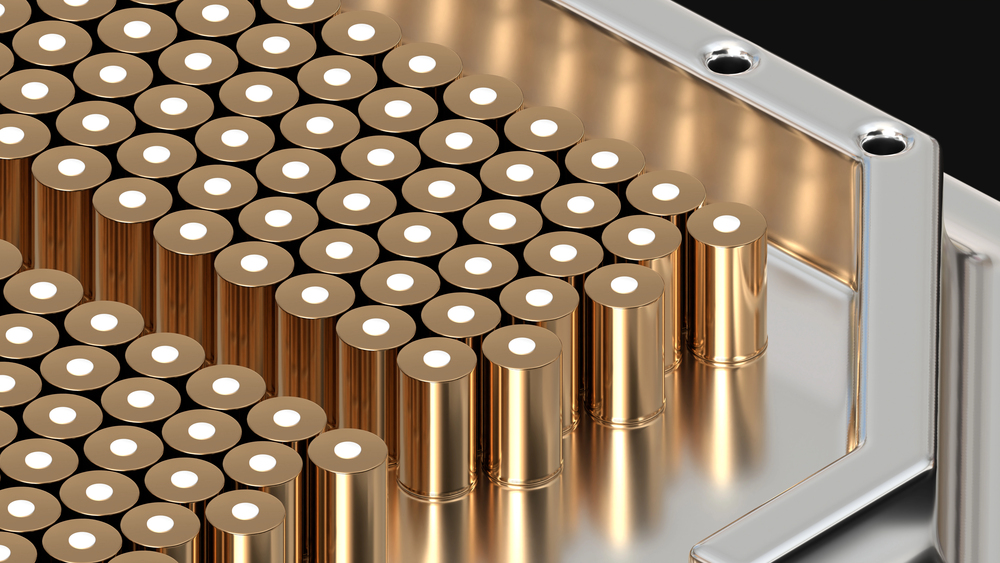

A report by IDTechEx, Second-life Electric Vehicle Batteries 2025-2035: Markets, Forecasts, Players, and Technologies, highlighted the challenges and potential of second-life batteries. These batteries, repurposed from electric vehicles (EVs), are primarily used for commercial and industrial applications like backup power at events, festivals, and construction sites.

Repurposers are exploring various revenue models, including renting battery systems instead of selling them outright. Renting can generate continuous revenue, making it more accessible for customers who lack the upfront capital to purchase a battery.

To reduce costs and time for battery disassembly, repurposers have requested that EV batteries be manufactured differently. Current cell-to-pack designs, while energy-dense, are difficult and expensive to dismantle due to structural adhesives and welds.

Proposing revenue-sharing opportunities with automotive OEMs could incentivize them to supply end-of-life batteries at lower costs. This collaboration could simplify the repurposing process and increase revenue for both repurposers and OEMs as the second-life battery market grows.

Furthermore, IDTechEx noted, advancements in battery testing technologies could lower repurposing costs. Smaller form-factor testing technologies allow tests to be conducted at service workshops without removing the battery from the EV. This could lead to partnerships between OEMs, repurposers, and service workshops, reducing costs and providing second-life batteries at more competitive prices.

Repurposers could also generate revenue by disassembling batteries to module or cell level, replacing faulty parts, and supplying refurbished battery packs to EV manufacturers with reduced warranties. However, many repurposers lack the supply chains to carry out these processes.

When predicting the market, the group looked to the EU where most OEMs are likely to recycle end-of-life batteries rather than repurpose them due to a lack of policies encouraging repurposing. This is especially true for high-value EV batteries containing nickel and cobalt. The EU Battery Regulation requires industrial and EV batteries to have minimum contents of cobalt, nickel, and lithium by 2031, with further increases by 2036. This regulation may push OEMs and battery manufacturers towards recycling to meet these requirements.

While there is potential for revenue in the second-life battery market, greater incentives and revenue-sharing opportunities with automotive OEMs are needed to drive growth.

Leave a Reply