From the Magazine: Counter Points

Share

Share

If you want to know what’s really happening in the automotive aftermarket, ask the people behind the counter at your local jobber.

They’re the ones fielding calls from frustrated techs, deciphering vague part requests and navigating the ever-expanding jungle of SKUs. They’re also the ones who know which brands are failing more often, which customers are getting harder to please, and which suppliers are showing up (and which ones are not).

And they’re the ones who, despite the daily grind, still find satisfaction in helping people get back on the road.

Now in its second year, the Annual Counter Professionals Survey lets us take a look at what may have changed over the last year, according to those on the front lines at jobber stores across Canada. It offers a deeper look into the realities of working at Canadian parts distribution outlets and found that, while some themes like the importance of training and the frustrations with poor-quality parts remain constant, others have shifted in subtle but telling ways.

With the rapid emergence of AI, this year’s survey looked to gauge the thoughts of counter staff on the technology. While some counter professionals are cautiously optimistic about its potential to streamline tasks and improve product lookup, others are skeptical, pointing out that no algorithm can match a human’s ability to eyeball a bolt or measure a belt. Still, it’s on the mind of the industry, suggesting that the aftermarket may soon have to reckon with its digital future.

Training continues to be a sore spot. Many respondents lamented the decline in manufacturer-led education and the lack of hands-on support from supplier reps. Yet there’s hope: Some stores are seeing a resurgence in vendor-led training, and counter staff are eager for more.

Customer behavior is also evolving. The “Google mechanic” phenomenon is alive and well, with DIYers increasingly misdiagnosing issues and returning parts that were never needed. Counter staff are calling for better communication and more respect for their expertise, especially as vehicles become more complex and diagnostic tools more essential.

And then there’s the quality issue. If last year’s survey hinted at frustration with “white box” parts, this year’s responses make it loud and clear: Counter professionals are tired of selling junk. They want better inventory, fewer returns and more accountability from suppliers.

One could say that this year’s survey paints a picture of an industry in transition. Counter professionals are adapting to new technologies, shifting customer expectations and a changing supplier landscape. But they’re also asking for help. They want more training, better tools and a seat at the table when decisions are made.

Here’s a deeper dive into the results.

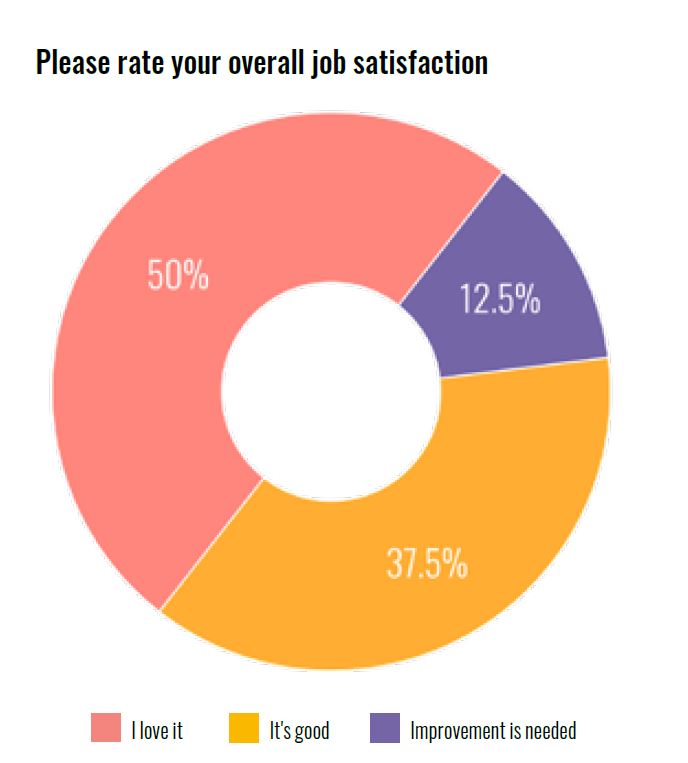

Counter pros continue to be positive about their jobs, though with a slight drop off from the first edition of the survey.

This year, 87.5 per cent said they either love their job or that it’s good. An overwhelming majority, but a drop from last year when 92 per cent responded positively.

Counter staff said that they find fulfillment in helping customers solve problems and keeping vehicles on the road.

“Helping customers find solutions to their everyday challenges,” one noted as to what gives them daily satisfaction.

Respondents emphasized the satisfaction of being part of a constantly evolving industry, especially with the rise of EVs and alternative fuels.

“Helping people get the most life out of their automobiles” is what one respondent said was a core motivator to going through the doors every day.

Also expressed was the pride in being the “go-to” person for tough questions. They enjoy the challenge of solving problems that others can’t, and they value the trust placed in them by technicians and customers alike.

Others noted that the variety of tasks, from sourcing rare parts to troubleshooting catalogue errors, keeps the job interesting and rewarding.

On the flip side, parts quality was a sore spot with one in particular pointing out that “I hate selling junk parts to mechanics and customers, as all parts are [terrible] quality.”

Other improvements noted were work conditions to make it more physically comfortable in the store. Air conditioning was one example.

“It’s always money, but even to make the workplace nicer to work in,” another pointed out. “Anti-fatigue mats and good stools go a long way.”

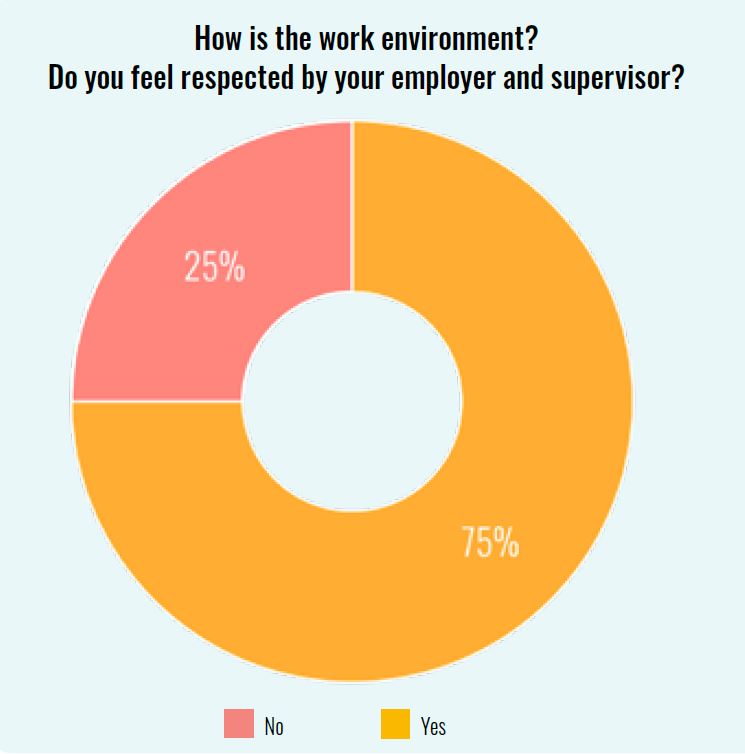

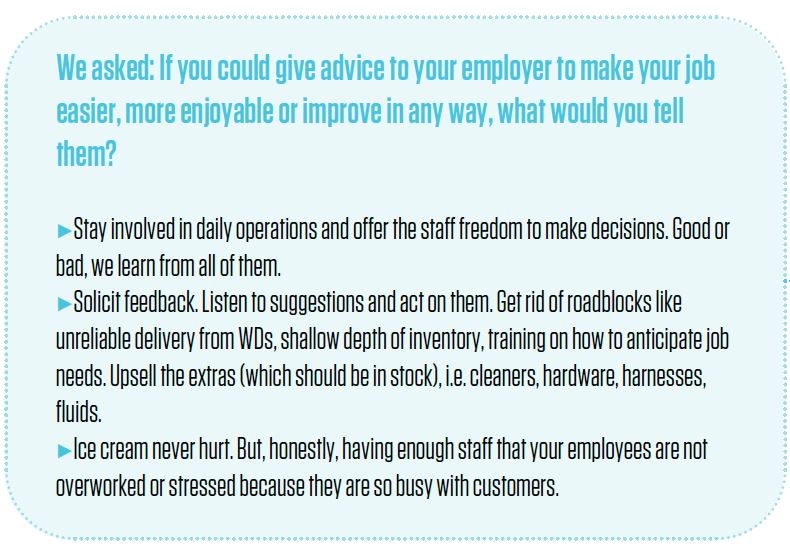

Respondents generally feel supported by their employers, especially when it comes to communication and being heard. Several noted that their input on decisions is valued, and they appreciate it when management provides encouragement and feedback.

Support from employers also includes flexibility and recognition. Several respondents mentioned that their managers allow them to make decisions on the fly, which helps them feel empowered and trusted.

Some noted that the best part of their day is the interactions they have, be it with the people they work with in the store or the customers who call them up.

“Helping people makes the day worth it,” one said.

However, some that have seen their store go from independent ownership to one now run by a larger corporate entity noted that corporate environments can feel impersonal and that they miss the camaraderie of smaller, independent stores.

Customer behaviour continues to be a pain point. Last year, lack of knowledge about the part needed (38.5 per cent) was the top pain point for when dealing with pro and DIY customers. This year, it was overtaken by incorrect or incomplete information provided about the vehicle being serviced — half of all respondents identified this as the biggest issue.

One complained about shops ordering parts before completing proper diagnostics. It seems the shop wants to have all possible solutions on hand for when they figure out the issue.

“Google mechanic is often wrong,” said another in a similar vein. “No returns should be allowed to DIY customers. We are not a buy-and-try store.”

The rise of online information has made customers more confident but not always more accurate. Counter professionals reported frequent encounters with customers who insist on specific parts based on internet research, even when those parts are incorrect. This leads to increased returns and wasted time.

And a seeming lack of respect for the work these counter pros do and the skills they have.

“We live in a ‘now’ world. After the pandemic, there are still parts shortages and we are constantly adapting to ‘no lead-times’ and finding options that ‘will fit’ to keep the trucks running with no appreciation for what it took to get a unit out of the shop and back on the road from both customers and technicians,” one respondent explained.

“Customers think most counter persons are just someone behind the computer, whereas a good counter person is as valuable as a good technician,” emphasized another.

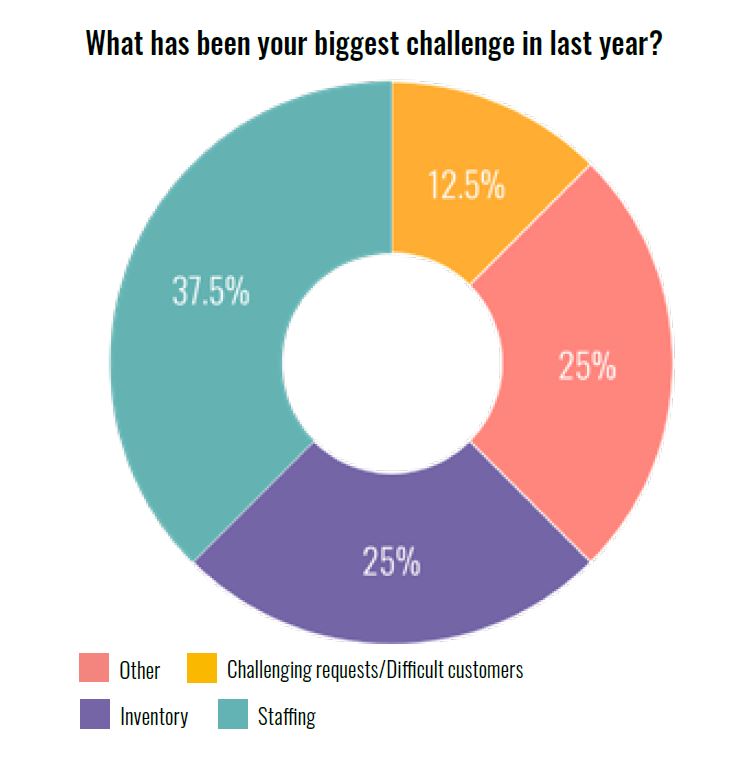

The lack of staff and talent shortages continues to be a thorn in the side of counter staff but not as big as before. This year, 37.5 per cent picked it as the top challenge, compared to 62 per cent last year.

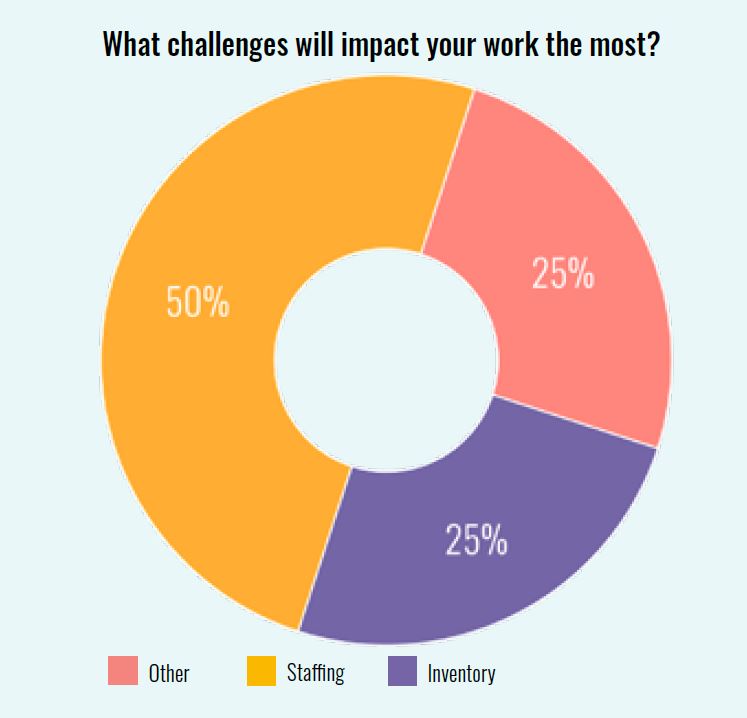

Inventory jumped from 15 per cent to 25 per cent this year. Other issues, like product knowledge and difficult customers, made up the rest.

“I am amazed at the lack of inventory and the lack of staff/people willing to work,” wrote one respondent who said they would choose all the options given.

Staffing shortages are affecting morale and performance. Some counter professionals have to multitask, covering phones, walk-ins and deliveries simultaneously. This can lead to burnout and mistakes.

And staffing (50 per cent) and inventory (25 per cent) will continue to be the biggest challenges going forward.

“New staff, product knowledge and learning the technical parts of the job,” one listed as ongoing challenges.

Another just wants more people behind the desk and they’re willing to help them learn.

“I need another counter person. Even a newbie would be fine. I’m always willing to teach the younger staff,” they said.

“Staffing. There are no young people knocking on the door,” another pointed out. “We are involved at both high school and college levels and [there is still] still very limited interest to our industry.”

They continued, mentioning other challenges like training and that vendors are now starting to offer onsite education on parts for staff.

As for geopolitical issues, if prices are going to go up due to tariff and other charges, having a consistent flowing supply is needed, they added.

“As an independent store, we fight the big chain stores as well as the internet,” said another respondent. “But as people are finding out with warranties and returns, the internet is not the place to buy their parts anymore.”

Inventory issues, ranging from too many SKUs to parts availability, were a common grip among counter pros. The growing variety of parts for ICE, hybrid, and EV platforms has made product lookup more complex.

“Too many choices do not help anyone. Keep brands based on quality, warranty and price. Maximum three choices,” one recommended.

The complexity of vehicle platforms has led to an explosion of SKUs, making inventory management and product lookup more difficult. Counter professionals are calling for better catalog systems and more intuitive software.

One noted that their systems are inferior. They “make us pay a license fee and don’t provide us with all the information to properly look up parts. At the same time, RockAuto has a better look-up than the one we pay to use,” the respondent said.

Support from suppliers, manufacturer representatives and vendor reps has become increasingly frustrating for counter staff.

“Would be helpful with more supplier training to keep up to date on the latest,” a respondent noted.

While some reps are praised for their dedication and product knowledge, others are described as “lazy” or absent. The decline in manufacturer-led training is a major concern, with respondents calling for more frequent visits and hands-on education.

“Product training goes a long way,” one counter pro explained, adding that they are starting to see more onsite training for both parts and service staff from vendors. “Unfortunately, they are not ‘involved’ in our business as they are spread out too thinly, i.e., territories are too large to cover by one person.”

Another echoed that concern. “Training and product support has declined significantly over the past few years as manufacturers have cut sales and training,” the respondent commented.

One pro was more critical, saying it’s hit or miss. “There are some great sales reps who keep us informed and updated on new info, but there are a lot who are lazy,” they said. “I miss the old school sales reps who returned calls/emails. There are only a handful of reps who I know and trust these days.”

There were also complaints about cheap packaging, leading to broken or refused parts.

“Warehouse partners don’t control the shipper but should take damage claims seriously as well as unkept promised delivery times,” one respondent said. “The part arriving on time, every time affects the jobber, installer and especially the end user who may be several thousand kilometers from their home and job. The same reps visit repeatedly and many brands remain unrepresented for years, if ever.”

While artificial intelligence has been a constant discussion point, it seems to only have a small foothold among jobbers and among counter staff.

Three-quarters of respondents said they don’t use AI at all, with the last 25 per cent saying it’s used a little bit.

That said, most respondents commented that they see how it can help, even if it’s not a major tool they use every day.

“ChatGPT has helped understand new trends in our market area,” one pro observed. “This is constantly evolving and we are looking forward to seeing where it brings us.”

One worried that it would be used to replace training. Another said it’s just a newer version of Google and a way for customers to get the wrong information.

“AI has potential to be both helpful and disruptive. Specifically trained AI platforms will be useful but come at a cost for reliability,” they explained. “General free AI relies on a flawed internet of information to return results. People will quickly tire of dealing with robots and seek out professional, experienced, humans for answers and recommendations. AI can be bought just like Google recommendations.”

Another pointed out that still can’t replace in-person expertise. “It can’t look at a bolt and match it up for a customer, or measure a belt for a customer,” they said.

This article originally appeared in the September 2025 issue of Jobber News

Leave a Reply