From the magazine: Under the Hood

Share

Share

Looking under the hood of Canada’s automotive aftermarket reveals a workforce driven by pride, resilience and a desire for respect. Automotive service advisors and technicians are the backbone of this evolving industry, navigating rapid technological change, shifting customer expectations and persistent challenges around pay and recognition.

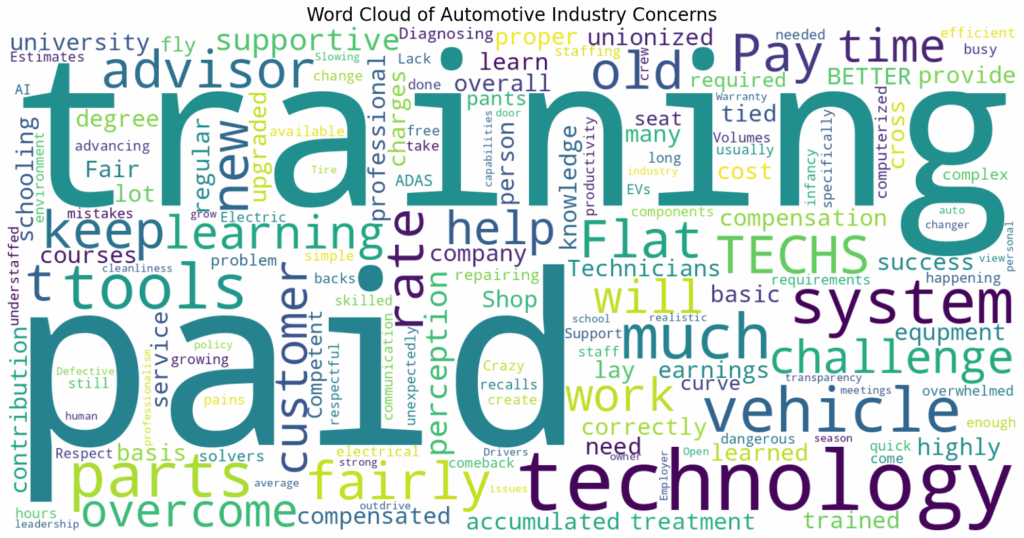

CARS magazine surveyed this segment of Canadian auto care professionals to gauge their opinions on pressing issues, their work environment, challenges and what’s working well in their day-to-day jobs. The results paint a nuanced picture: While many professionals find fulfilment in solving problems and helping clients, others are grappling with outdated compensation models, limited training and a lack of support. The rise of artificial intelligence, the shift to electric vehicles and the complexity of diagnostics are reshaping the trade — and not everyone feels ready.

Yet despite the hurdles, most respondents remain committed to their craft, finding satisfaction in the work and camaraderie in their shops.

If one were to distill the voices into one message, it may be this: The industry must evolve to retain its talent, support its people and prepare for the road ahead. From frustrations with flat rate pay to optimism about new tools, the responses offer insight into what’s working, what’s not and what needs to change.

Let’s take a closer look at what keeps this sector running — and what might stall it if left unchecked.

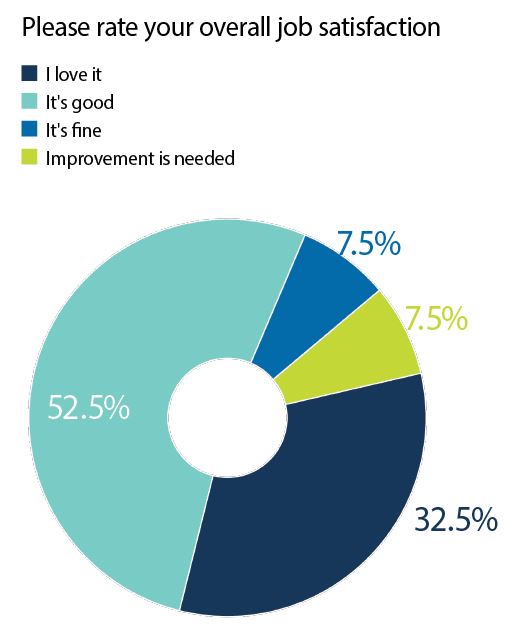

Job satisfaction stayed mostly positive year-over-year, though the level of excitement might have dropped a notch. Last year, 36 per cent said they love their job, compared to one-third this year. However, when combined with those who have a “good” level of satisfaction with their job, the overall positive feelings sit at 86 per cent.

For many service advisors and technicians, the job is about more than just fixing vehicles. It’s about fixing days.

“Making a customer’s bad day better” is how one summed up why they love what they do.

That sense of purpose came through again and again, with others saying they find satisfaction in “helping people” and “pleasing customers when finished.”

The challenge of solving problems keeps them sharp. And the reward is often immediate: A happy client and a job well done.

There’s also a thrill in the variety.

“Interesting people and new situations to resolve every day,” one professional said.

“The challenge of the job and satisfaction of solving the issue,” another pointed out. “It results in a pleasing customer when finished. Keeps me sharp and focused.”

But it’s not all smooth driving. Some pointed to the pressure to upsell, even when it didn’t feel right.

Always found there was almost too much pressure to sell more, even when jobs were not required,” one wrote in.

Others mentioned staffing issues, like being “too busy for one person and having trouble finding a second advisor.”

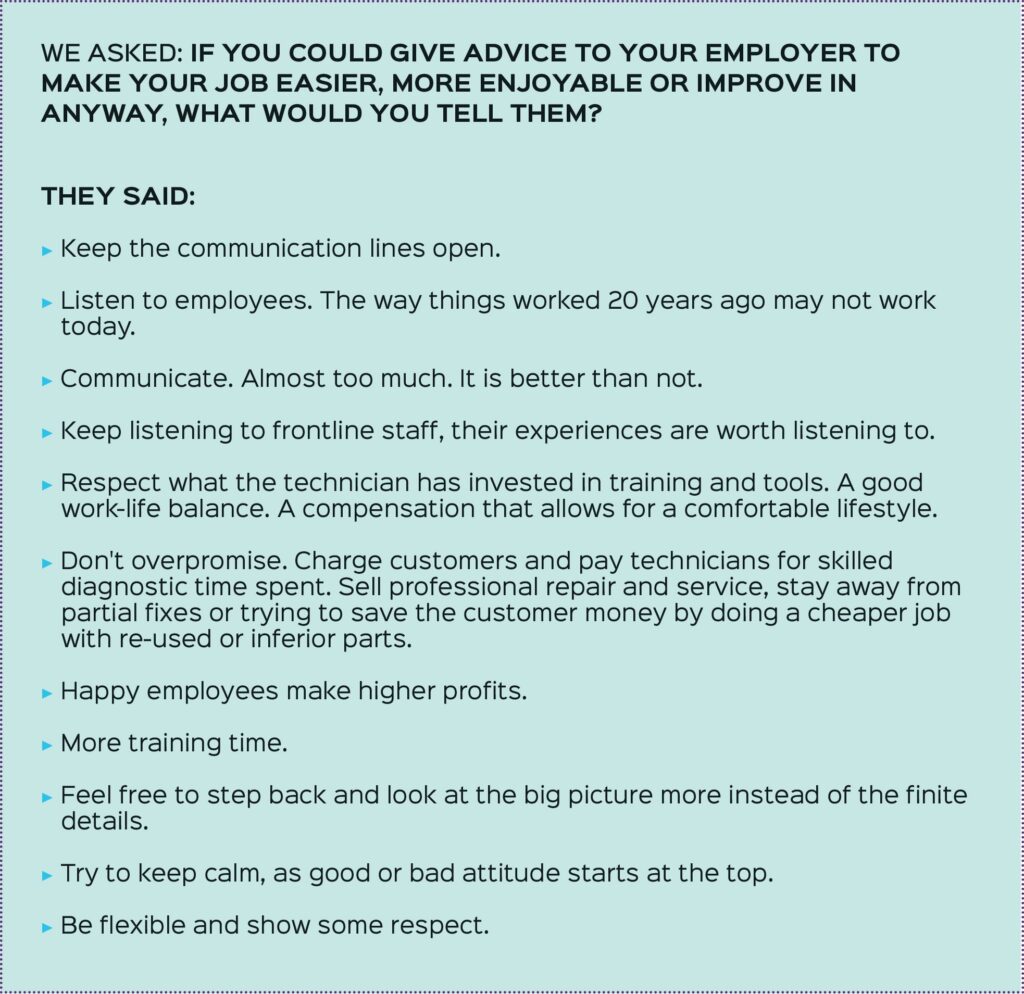

Most service advisors and technicians feel respected and supported at work, as 87.5 per cent said yes when asked about their work environment. That’s a slight dip from last year’s 91 per cent, but still a strong majority. And when given the chance to comment, many shared stories that backed up those numbers.

Others pointed to teamwork and communication as key strengths, though not without room for improvement. “Good at explaining, teamwork. Could improve on communication in the shop,” one professional noted.

Transparency and openness came up often. Weekly check-ins and fair treatment were mentioned as positive.

“Open door policy and transparency about the business,” one respondent said. Another praised their employer for “excellent pay, training resources and good management,” though added, “we could use more staffing at peak times.”

Recognition and respect also stood out. One respondent noted how their shop is “good at working hard to provide proper compensation, respectful work environment, recognition,” though they added, “better follow-through and more accountability would be good.”

When asked about their biggest challenge at work, the top answer was clear: “We’re too busy.” That response came from 35 per cent of those surveyed, and, while mentioned earlier, the comments here backed it up.

“More staff because we get overwhelmed with work and not enough time to do it all,” one person said. Another added, “Being understaffed in a shop is dangerous. Asking a tech to look at a vehicle on his lunch break because shops are so busy is a very bad habit to have.”

Busy shops aren’t just about volume, they’re about expectations. “Clients book appointments without divulging proper information for proper diagnosis, or add 10 additional items to look at and expect the same time frame for completion,” one technician explained.

Training was another major concern, cited by 13 per cent of respondents. Some said they get regular support: “We get regular training, cross-training and support,” one respondent noted.

But others described a very different experience. “No training, just fly by the seat of your pants,” one wrote. Another said, “I have never went for any service advisor training, although I’ve been doing this for over 25 years.”

Service advisors are confident in their core responsibilities. When asked if they understand how to book the schedule for maximum productivity, 94 per cent said yes. Nearly as many (91 per cent) said they know how to gather the best information to help technicians diagnose vehicles correctly. And 97 per cent said they have enough education on vehicle service to effectively advise clients.

But not everything is running at full efficiency. Only 53 per cent said their shop books the client’s next appointment at the end of each service. And while 69 per cent said they were educated on how to qualify clients, that leaves nearly a third who were not.

When it comes to parts, most advisors said they’re selling higher-quality options with 53 per cent said they sell “best” quality parts more often, 38 per cent said “better” and 9 per cent said “good.”

“Found it better to offer customers good parts with warranty, but will supply lower-priced parts if the customer asks for them,” was how one advisor explained their approach.

Artificial intelligence is starting to show up in some shops — but not all. More than half (59 per cent) said they don’t use AI at all, while 28 per cent said they use it a little, and 13 per cent said they use it as much as possible.

“AI has not been considered at this time as I feel the empathetic ‘human touch’ is one of the keys to our success over the last 40 years,” one advisor said.

Another said AI is “helpful for writing clear information to customers.” One added that “We haven’t started using AI but feel this will be an asset.”

Technicians are mostly confident in their ability to do the job but not without some caveats. The survey found that 71 per cent said they have the training they need and 81 per cent said they have the tools. But only 58 per cent said they’re given enough time to diagnose and repair vehicles correctly. That gap showed up clearly in the comments.

“Diagnosing time has always been a touchy subject,” one technician wrote. “No one believes they should pay for it, yet in a flat rate shop that tech deserves to be paid.” Another added, “Diagnosis should be paid time.”

But one disagreed. “Money is made on common repairs. One does not make money on diagnostics. However, you need to be able to diagnose your customers’ occasional difficult issues to retain them as customers and be able to sell them more general money-making repairs.” They added that the time required to diagnose a problem is simply “the time it takes to diagnose it.”

Customer expectations are also rising. “Clients’ expectations are rising all the time yet with little understanding of what it actually takes to resolve complex issues,” one technician said.

As for artificial intelligence, most technicians aren’t using it yet as 67 per cent said they don’t use AI at all, while 23 per cent said they use it a little, and 10 per cent said they use it as often as possible. Those who do use it say it helps with writing descriptions, referencing specs and checking maintenance history.

But the bigger issue may be attracting new talent. One technician pointed to the root of the shortage: “Pay better. The reason no new techs is pay and flat rate system. No new blood getting in because almost all other trades are cheaper (tools) and pay better.”

When asked if they could see themselves continuing in the trade for the rest of their career, 68 per cent said yes. That’s still a solid majority — but it’s a noticeable drop from 2024, when 82 per cent said yes. This year, 23 per cent said “maybe” and 10 per cent said “no.” Last year, only 9 per cent said “maybe” and 9 per cent said “no.”

There may be some clues in the written responses. Many pointed to physical strain and aging. “The body can only last for so long. I will transition to a less intensive job in the coming years,” one person said. Another added, “Physical limitations as I age. Compensation to feel adequately appreciated.”

Others pointed to management and workplace culture, noting “Improper management,” or “No support from management,” were some examples.

“If I am forced to make a personal decision on moving out of my current area and can’t find a shop that has the values I hold high,” was another reason given.

Pay and benefits also came up often. “Insufficient pay and benefits. Lack of a pension,” one respondent said. Another added that the “constant upgrades and buying new tools and the lack of good pay for what you need to do” as a barrier for sticking around.

Pay has come up several times already and the survey gave techs and advisors the opportunity to weigh in specifically on the topic. In 2024, 91 per cent of respondents said they felt they were paid fairly for the work they do. This year, that number dropped to just 60 per cent.

Some still feel they’re being compensated fairly. “Compensation plan where I work is equitable to all workers, earnings tied to contribution to overall success of the company,” one person said. Others noted that their rate is set by the shop and they’re satisfied with it.

But many others pointed to long-standing frustrations, especially with the flat rate system. “I felt the flat rate system was old, and it causes comebacks that are usually done for free,” one respondent said. “A technician should not have to consider himself a business to make a living. That’s what flat rate does.”

The cost of tools and training also came up repeatedly. “Considering the outlay in tools and the amount of accumulated knowledge, a technician should be paid as much or more than a person with a basic university degree,” one respondent said.

“Most shops want you to know everything and have the tools to repair everything but don’t want to pay you,” one professional wrote.

“The automotive trade is so underpaid because we have to provide so many tools and can’t claim them on our income tax,” another highlighted.

There’s also frustration with how wages have stagnated. “Pay has not evolved since 2008 — 17 years later, still making near same flat rate,” one pointed out.

When asked whether technology advancements worry them, while some said they’re not concerned, others expressed serious doubts, especially around EVs, ADAS systems and the pace of change.

“Not so sure about electric vehicles,” one person said. “Sometimes the advancement in technology is happening too quick, but the techs will have to keep up or the shop will fall behind.”

Another added that “this tech is still in its infancy by standards and will have growing pains.”

But some don’t feel equipped. “Electric vehicles concern me somewhat, because I don’t have the best handle on electrical systems or components,” one pro said.

ADAS systems were a particular concern, with one noting they have “already affected our business in doing alignments,” one person said. “The cost and space involved is not practical for most shops.”

Some are taking a strategic approach. “I will slowly implement the technology and make lots of money doing general repairs,” one professional said. “Any high voltage issues will be directed back to the dealer for the customer to trade their vehicle in on a new one because the repair cost will probably be more than the vehicle is worth.”

One respondent raised a broader concern about how the trade is perceived

“Future advancements (and current) do concern me, as the industry is still seen by some as a job path for people who have learning or development challenges. Diagnosing and repairing complex computerized systems requires fairly highly literate problem solvers. This is becoming an industry where an intelligent technician should be seen as, and compensated as, a highly trained, learned professional.”

This article originally appeared in the October issue of CARS magazine

Leave a Reply