From the Magazine: Under Pressure

Share

Share

The automotive aftermarket is no stranger to change, but 2025 has brought a perfect storm of economic headwinds that’s testing the resilience of jobbers across Canada. As the cost of doing business climbs and global supply chains tighten, parts retailers are being forced to rethink how they manage inventory, pricing and customer expectations.

At the heart of the issue is uncertainty — uncertainty around tariffs, around interest rates and around the flow of goods from overseas. The cost of borrowing remains high, increasing the level of difficulty for jobbers to invest in inventory or expand their operations. For many, purchasing power has been diminished and every dollar spent has to stretch further than ever before.

Meanwhile, the global shipping slowdown is beginning to bite. The world’s five largest containership operators say bookings for eastbound trans-Pacific shipments are down by at least a third. In early May, the Port of Los Angeles expected container arrivals to be down by 30 per cent week over week. There are clear signals that the flow of parts and products from overseas is slowing.

Aftermarket companies, according to Auto Care Association president and CEO Bill Hanvey, are even refusing to accept shipments that originate from China for fear of the exorbitant tariffs.

For jobbers, this could mean more pressure to make the right inventory bets. Some are responding by buying ahead of additional potential tariff hikes and implementation, hoping to lock in pricing and availability before the next wave of economic turbulence hits. But that strategy comes with risk — especially when cash flow is already under strain.

“We have also made the point in discussions that there’s been no relief on the auto tariffs yet for automotive aftermarket suppliers,” said Paul McCarthy, president of MEMA Aftermarket Suppliers, during a second-quarter media call.

He noted that the aftermarket has a bigger impact on the average consumer than the new vehicle market — and most people aren’t even in the market for new vehicles as they can’t afford them. DesRosiers Automotive Consultants reported that the average price for a new vehicle in Canada at the end of 2024 surpassed $45,000 for a passenger car and hit almost $55,000 for a light truck.

And then there’s the issue of pricing. As costs rise at every stage of the supply chain — from manufacturing to shipping to warehousing — those increases inevitably make their way to the end customer. Consumers are already feeling the pinch and jobbers are caught in the middle, trying to maintain margins without alienating shop partners.

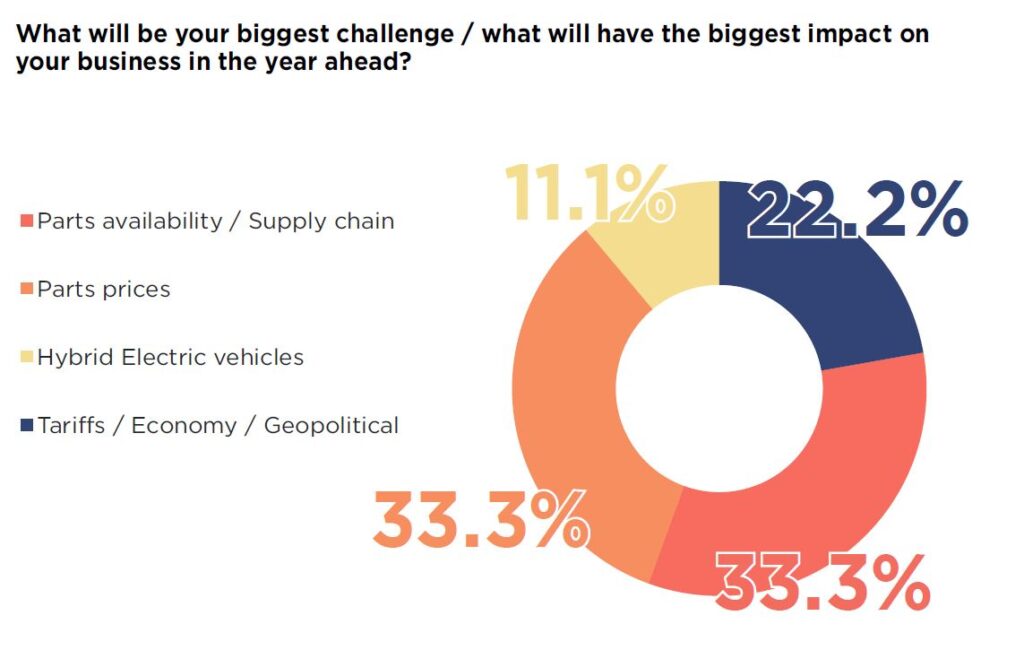

The 2025 CARS Annual Jobber Survey reflects this tension. Respondents cited parts prices, supply chain disruptions and economic uncertainty as their top concerns. One jobber noted they were “ordering on the heavier side in anticipation of the tariffs,” while another pointed out that “our parts margin has to pay all of our bills.” These aren’t just passing frustrations — they’re signs of a sector under real pressure.

Yet amid the challenges, there’s also resilience. Jobbers are adapting, finding new ways to serve their customers, and leaning into the relationships that have always been the backbone of the industry.

This year’s survey paints a picture of an industry in flux — one that’s grappling with global forces but still grounded in local relationships. It explores what jobbers are saying, what they’re doing, how they’re preparing for whatever comes next — and how they view the state of how their shop partners are doing business.

If 2024 was a year of adaptation, 2025 has been a year of endurance. Jobbers across Canada are navigating a complex web of economic, technological and supply chain pressures — and the road ahead doesn’t look much smoother.

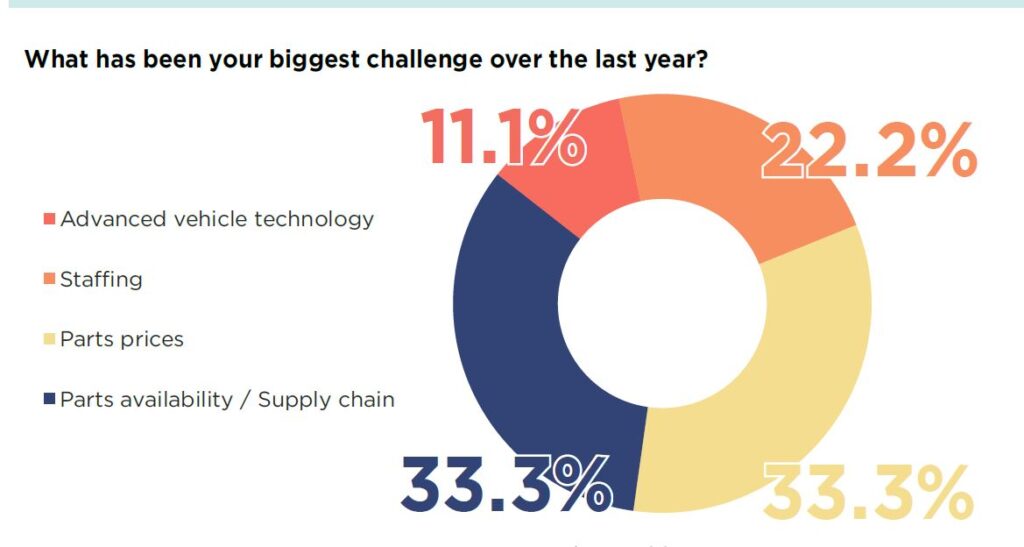

When asked about their biggest challenge over the past year, jobbers were nearly unanimous: Parts prices topped the list. The cost of goods has continued to climb, squeezing margins and forcing tough decisions on what to stock and how to price it.

But pricing wasn’t the only concern. Several jobbers flagged parts availability and supply chain disruptions, which have made it difficult to meet customer expectations.

“With the amount [of] price changes we are seeing daily, and the on again off again proposed tariffs announcements, it’s leaving a lot of uncertainty in the automotive market,” one jobber said.

Another pointed to industry consolidation as a looming issue.

“Acquisitions are limiting our ability to shop around for the best products as there are fewer manufacturers to choose from,” they commented.

Staying lean was also a theme among the comments, saying that a top challenge was to keep prices low while one pointed out that they’re going to “focus on controllable factors.”

How will they stay ahead of these challenges? “Personable and knowledgeable front-line people,” observed a jobber.

To sum it up, jobbers are juggling rising costs, shifting technologies and a supply chain that’s anything but predictable. But they’re also adapting, strategizing and staying focused on what they can control.

When it comes to inventory, they’re not worried … yet. As noted, they’re buying ahead of anticipated higher expenses. One jobber noted that inventory is good, but they do “expect a few supply issues.”

The widening spectrum of vehicle age is adding to the challenge, however. They noted their inventory levels are getting “higher and higher” and that “a lot of parts are getting harder to find.”

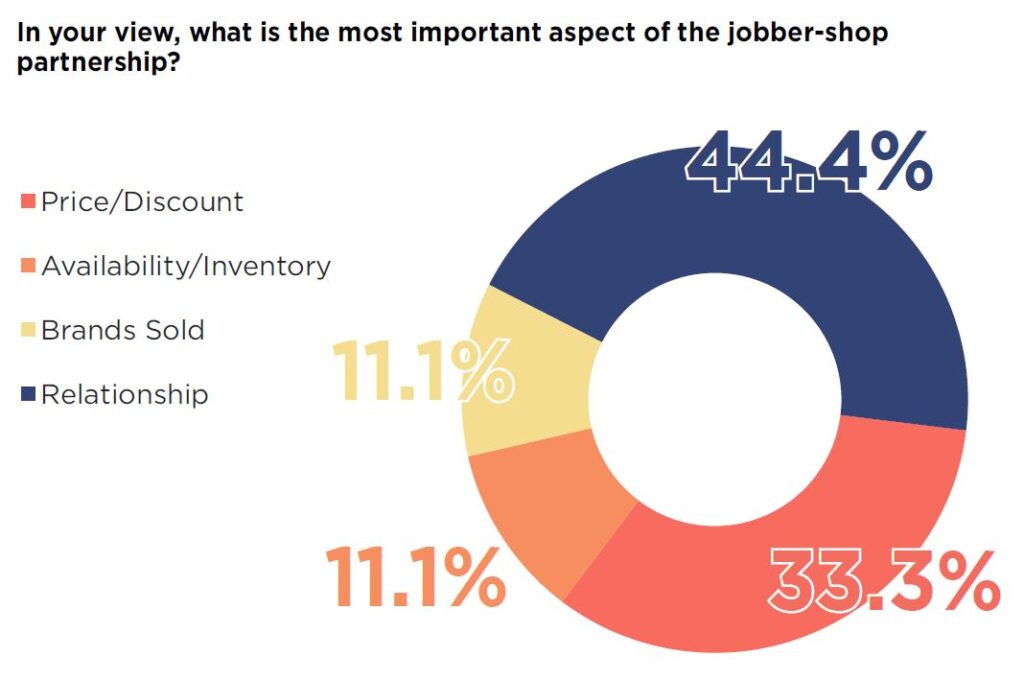

The dynamics of jobber-shop partnerships have always been complex, but the Annual Jobber Survey revealed some intriguing shifts in priorities. While relationships remain a cornerstone for jobbers, the importance of price and availability has surged, reflecting the economic pressures your partners are facing.

In 2024, 52 per cent of respondents cited relationships as the most important aspect of the jobber-shop partnership. This year, that number has dropped to 44 per cent. Meanwhile, the emphasis on price has jumped from 5 per cent to 33 per cent, and availability has also seen a significant increase, from 11 per cent to 33 per cent.

But those relationships can quickly erode. If a shop wants to stay in the good books of their jobber, there are relatively simple boxes to check.

The fastest way to build trust, according to respondents, is to be reliable and consistent.

“Be of your word; integrity,” one jobber advised.

Communication-themed responses came up regularly in the responses.

“Communication is the best [way] to build a relationship and it’s also the fastest way to kill a relationship as well,” one jobber said, indicating that poor communication or a non-existent communicative relationship does no one any favours.

Jobbers want to deal with personable people as well — just as a shop wants the same type of person answering their calls.

And when you’re on the phone, “Discuss with the supplier what parts are quality products,” one advised.

“Having the parts available and delivering good service will usually build a strong relationship and not going through with your promises/commitments will crush it quickly,” summed up another response.

Behind every part delivered and every invoice sent, there’s a story jobbers wish their shop customers knew. Respondents were asked to share what they most want shops to understand about the challenges they face. The answers reveal a mix of economic strain, operational complexity and a deep desire for mutual respect.

One of the most common refrains was about the financial pressure jobbers are under.

“Our parts margin has to pay all of our bills,” one jobber simply put it.

Rising costs are squeezing profitability. Jobbers want shops to know that pricing isn’t arbitrary — it’s a reflection of the real costs of doing business.

Several jobbers pointed to ongoing issues with parts availability, whether it’s delays from overseas suppliers or inconsistent inventory from manufacturers.

As consumers feel the pinch financially, their buying choices are varied. Some are choosing affordable options, while others see the value of investment in their vehicle. Having such a wide range of options ready to go out the door is a challenge.

“Parts proliferation,” one highlighted as a challenge.

“Delivery schedules from our WDs. How returns affect our productivity and cost of doing business,” said another.

They’re trying — really, pointed out another. Your jobber wants you to know “that we are very busy and trying very hard to be the best we can be, but sometimes we make a mistake or fall short on expectations, but it is not on purpose and we will try to learn from it and hopefully not repeat,” they said. “There are many times we simply get overloaded with orders and no matter how many people we have, there would still be a problem. We just don’t have a regulator to control the orders coming in.”

Lastly, one highlighted the value of working with your physical jobber as opposed to a virtual parts distributor.

“The value of a brick-and-mortar parts store has to offer them versus online parts stores that may have cheaper parts,” they said.

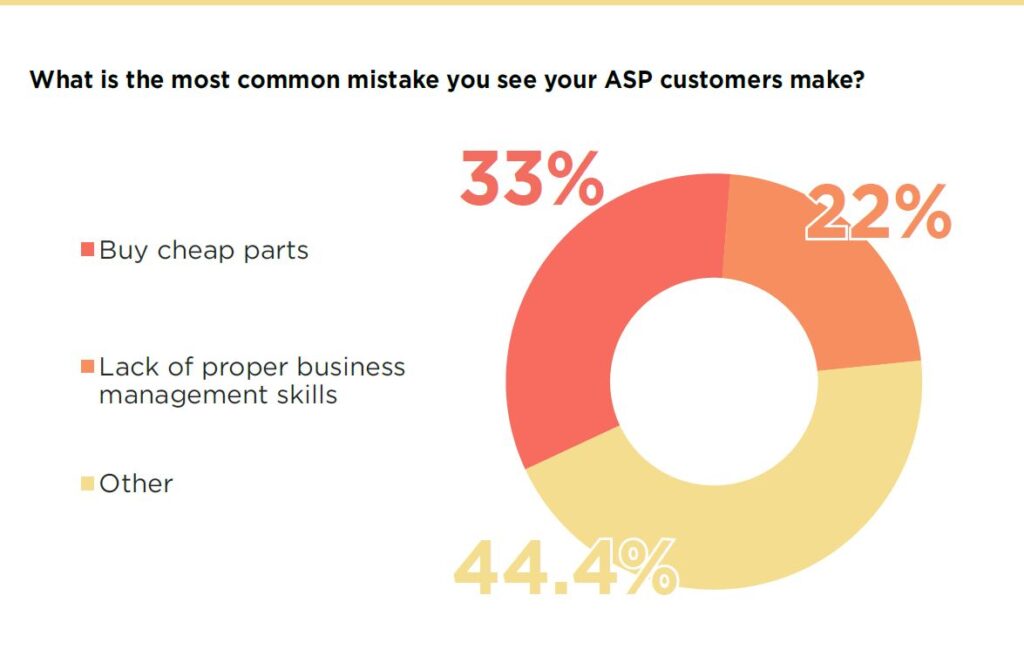

Jobbers have a front-row seat to the daily operations of their ASP customers — and they’re not shy about pointing out where they see deficiencies. They were asked to identify the most common mistakes they see shops make. The responses paint a clear picture of recurring issues in the field.

Two themes dominated the responses: buying cheap parts (33 per cent) and poor business management (22 per cent). While “buy cheap parts” was the top answer in 2025, it’s worth noting that this issue actually increased from 24 per cent in 2024. On the other hand, “lack of proper business management skills” saw a notable drop — from 33 per cent in 2024 to a smaller share this year — though it still featured prominently in open-text responses.

Jobbers expressed frustration with shops that prioritize price over quality. One respondent said shops are “catering to price shoppers” and “should be only offering quality.” Another noted that many ASPs “don’t understand nor care to” improve their business practices, suggesting a lack of interest in long-term growth.

“Perhaps they are too busy or they feel that the customer will perceive the extra work as unnecessary but they should make the time to do so, or train the techs to do so, as usually the car owner does not know the workings of their car and if conveyed properly, the shops could show the customer that they are trying to help prevent bigger problems and inconvenience later on, by doing the maintenance or repair now,” a jobber explained.

When asked why these issues persist, jobbers pointed to a mix of inexperience, lack of training and short-term thinking. Some shops rely too heavily on supplier-suggested retail pricing without understanding markup strategies. Others simply don’t invest in the tools or training needed to run a modern, efficient business.

As one jobber summed it up bluntly: “Good technician does not always make a good shop owner.”

A skilled technician goes through training, invests in equipment and gains confidence through experience. That makes them as important as any professional job you can imagine out there, one jobber pointed out. They need to view themselves as such.

“Skilled technicians should value their time and knowledge no less than any other profession, such as a doctor, lawyer, professor, etc.,” they wrote. “A professional technician is not the equivalent of an orderly, secretary or teacher’s aid. Diagnostic time is more valuable than installer time.”

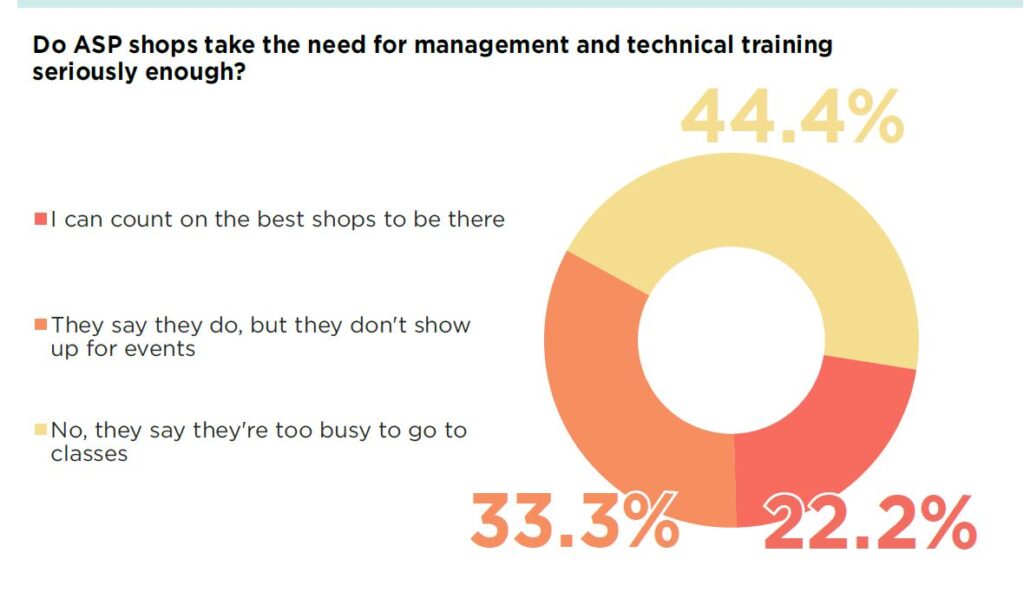

The survey also asked whether ASPs take management and technical training seriously. The results suggest a disconnect between what shops say and what they do.

While the data improved this year in some areas, it became more concerning in others. For example, the number of jobbers that reported shops saying they’re too busy to attend fell from 62 per cent to 44 per cent. However, there was a jump from 10 per cent to 33 per cent of jobbers saying their shop customers committed to attending training but didn’t show up.

Jobbers are clearly frustrated by the lack of follow-through. One noted that many techs “hide behind the pandemic-era excuse” of preferring online training but then fail to complete it.

“There is a vast amount of inexpensive or free training available but not much accountability for employees to take courses and demonstrate understanding of what the course taught,” they continued. “In-person training is invaluable when attended. Networking with others, sharing knowledge and writing a short exam to earn a certificate are all great benefits, not to mention if there is a meal.”

Location is an issue, noted one jobber. “The good shops want the training and will make the time, but unfortunately, we are geographically somewhat isolated, making it hard for most shops to attend hands-on training, while online training just doesn’t seem to have the attraction required.”

Others understood that techs work long hours all week and getting excited for after-hours training doesn’t excite them.

Another, however, noted that “I see a lot of smaller shops not investing in their techs to keep up with the changing technology in today’s vehicles.”

This article originally appeared in the June issue of CARS magazine

Leave a Reply